- What is Available For Sale Securities?

- Available for Sale Securities Example

- Available For Sale Securities Journal Entries

- #1 – Purchase of Securities

- #2 – Decline of Value

- #2 – Increase in Value

- Available for Sale Securities in Banks and Financial Institutions

- Differences Between Available for Sale Securities vs. Trading Securities vs. Held to Maturity Securities

- Conclusion

- Available For Sale Securities Video

- Recommended Articles

What is Available For Sale Securities?

Available for Sale Securities are those debt or equity securities investments by the company that are expected to sell in the short run and therefore will not be held to maturity. These are reported on the balance sheet at fair value. However, any unrealized gain and losses arising out in such securities are not recognized in the Income Statement but are reported in other comprehensive income as a part of shareholders’ equity. Any dividend received on such securities, interest income and actual gains and losses when the securities are sold are recognized in the Income Statement.

Available for Sale Securities Example

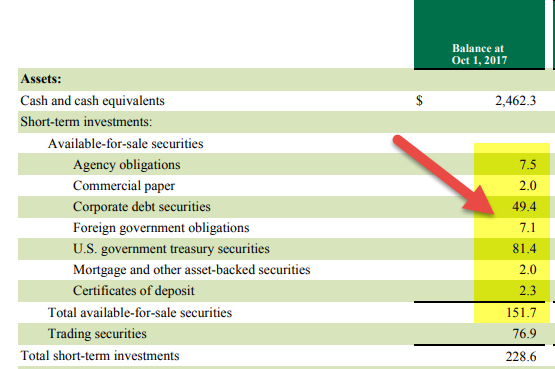

source: Starbucks SEC Filings

Bạn đang xem: available for sale là gì

Available for Sale Investments for Starbucks included Agency Obligations, Commercial Paper, Corporate Debt Securities, Foreign government obligations, US treasury securities, Mortgage, and other ABS, and Certificate of depositsCertificate Of DepositsCertificate of deposit (CD) is a money market instrument issued by a bank to raise funds from the secondary money market. It is issued for a specific period for a fixed amount of money with a fixed rate of interest. It is an arrangement between the depositor of money and the danangchothue.com more.

The total fair value of such securities was $151.7 million in 2017.

Xem thêm: Tổng hợp 5 modules chính của Brand Marketing

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Available For Sale Securities (wallstreetmojo.com)

Available For Sale Securities Journal Entries

ABC Bank buys $100000 equity Securities of Divine Limited on 0789277892 , which is classified as AFS in its books of accounts. ABC Bank realized at the end of the accounting year that the value of Available for Sale investment has declined to $95000 by the end of the period. At the end of the second-year value of investment increased to $110000, and ABC Bank sold the same.

#1 – Purchase of Securities

Journal Entry to record the purchase of $100000 of equity securities of Divine Limited is mentioned as follows:

#2 – Decline of Value

Journal Entry to record the decline in the value of equity securities at the end of the year is mentioned as follows:

#2 – Increase in Value

Đọc thêm: Hot Hot Marketing công nghiệp (Industrial marketing) là gì? So sánh với Marketing tiêu dùng

Journal Entry to record the increase in the value of equity securities at the end of the second year, as well as the sale of an investment, is mentioned as follows:

Thus we can see when an Available for Sale investment is classified under the AFS category; any unrealized gain or loss is reported in the Other Comprehensive IncomeOther Comprehensive IncomeOther comprehensive income refers to income, expenses, revenue, or loss not being realized while preparing the company’s financial statements during an accounting period. Thus, it is excluded and shown after the net danangchothue.com more as shown above in the case of ABC Bank. Once the same is realized on the sale of such securities is reported in the Income Statement.

Available for Sale Securities in Banks and Financial Institutions

They are broadly classified by Bank and Financial Institutions under the Banking Book or the Trading bookThe Trading BookTrading book is the type of book maintained by the bank, financial institution or a stockbroker banks for recording the transactions of the clients who have given them an opportunity to act as the broker or middle person for dealing in securities. read more.

- Banking Book refers to assets on a Bank’s balance sheet that is expected to be held to maturity. Banks and Financial Institutions are not required to mark these assets on a mark to market (MTM) basis, and such assets are usually held at historical cost in the books of accounts of the company. The popular category includes assets under Held to Maturity (HTM) category.

- Trading Book refers to assets held by a Bank which are available for sale and are traded regularly. These assets are acquired with the intent not to be held till maturity but to profit with them over the near term. Banks and Financial Institutions are required to mark these assets on a mark to market (MTM) daily, and such assets are recorded at fair value, which is also known as Mark to market accounting. The popular category includes assets held under the Held for Trading (HFT) category and Available for Sale (AFS) category.

Differences Between Available for Sale Securities vs. Trading Securities vs. Held to Maturity Securities

Conclusion

Available for Sale Securities is an important category of an investment portfolioInvestment PortfolioPortfolio investments are investments made in a group of assets (equity, debt, mutual funds, derivatives or even bitcoins) instead of a single asset with the objective of earning returns that are proportional to the investor’s risk danangchothue.com more that is held in the books of accounts of Banks/FI. The intent of the management decides the classification of Available for Sale investment. By classifying these under the AFS Securities category when fair value is down, the unrealized loss can be reported in Other Comprehensive Income without impacting the Income StatementIncome StatementThe income statement is one of the company’s financial reports that summarizes all of the company’s revenues and expenses over time in order to determine the company’s profit or loss and measure its business activity over time based on user danangchothue.com more.

Available For Sale Securities Video

Recommended Articles

This article has been a guide to what is Available for Sale securities and its definition. Here we discuss its examples along with available for sale securities journal entries and how Banks and Financial Institutions report it. You may also learn more from the following accounting articles –

- Long-Term Debt in Balance Sheet

- Tangible vs. Intangible Assets Differences

- Marketable Securities on the Balance Sheet

- What are Asset-Backed Securities?

- Capital Reserve and Revenue Reserve