About Unit Investment Trusts

Unit investment trusts (UITs) can be a powerful way for investors to gain exposure to timely opportunities as part of their overall investment plan.

From broad-based strategies to more niche market segments, Guggenheim Investments offers professionally selected portfolios that provide access to asset classes, investment styles, and market sectors in a single transaction.

Bạn đang xem: quỹ đầu tư tín thác là gì

Like traditional mutual funds and exchange traded funds (ETFs), UITs are packaged investment products offering daily liquidity, while providing investors with the opportunity to own a transparent and fully invested1 basket of securities.

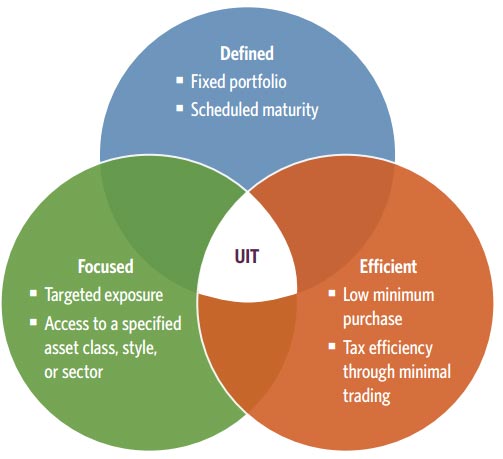

A Unique Investment Structure

UITs can potentially function as an effective complement to a well-balanced portfolio.

Đề xuất riêng cho bạn: Mách bạn ICO là gì? Cách phân tích trước khi đầu tư một dự án ICO

■ Security has these attributes □ Only actively managed ETFs have these attributes

Defined

The defined nature of UITs may make them an effective strategy to align with investment objectives. The portfolio is transparent and generally remains fixed for the life of the trust. Investors know exactly what they own for the duration of the investment. This defined approach ensures that UITs do not experience style drift. A UIT portfolio is not typically impacted by unnecessary trading driven by emotional reactions to market movements.

Focused

The UIT provides access to a specified asset class, investment style, or sector through a diversified4 basket of securities.

Dành cho bạn: Bạn có biết Vốn đầu tư nước ngoài là gì? Phân loại các nguồn vốn đầu tư từ nước ngoài

Typically more concentrated than other packaged investments, the UIT structure seeks to deliver targeted exposure, which may serve to enhance return potential.

Efficient

Through one relatively low minimum purchase, investors can own a portfolio of professionally selected securities, which are monitored on a continuous basis. In addition, due to their defined nature and structure, UITs may also offer a degree of tax efficiency.

Upon maturity of a UIT, investors have several distribution options, which include rolling the maturing proceeds into the same or similar strategy, receiving the cash value of the trust units, or requesting an in-kind distribution of the trust’s underlying securities.5

Guggenheim Expertise

Guggenheim manages a broad UIT lineup, offering more than 65 products, covering a variety of asset classes and investment themes. We provide equity and multi-asset UITs, as well as fixed-income options that include taxable, municipal, and laddered strategies. Our investment teams are committed to analyzing and identifying attractive opportunities across global markets. We seek to advance the strategic needs of our clients by delivering timely strategies with high conviction, while assessing risk at the security, sector, and portfolio composition levels.