Capital Account Definition

The capital account in accounting refers to the general ledger that records the transactions related to owners funds i.e. their contributions as well as earnings earned by the business till date after reduction of any distributions such as dividends. It is reported in the balance sheet under the equity side as “shareholders’ equity” in the case of a company. For a sole proprietorship, it is represented as “owner’s equity”.

Explanation

- For a sole proprietorship, the amount in this account would consist of the proprietor’s contributions net of any amounts withdrawn, i.e. drawings and accumulated profits to date.

- Similarly, for a partnership firm, this account would include the outstanding balances of capital contributions of the partners after accounting for drawings made by them and profit distributions done to them in accordance with the profit-sharing ratio. While drawings would reduce the capital balance, the profit appropriation to partners would increase their capital accounts.

- Talking about the company, it includes share capitalShare CapitalShare capital refers to the funds raised by an organization by issuing the company’s initial public offerings, common shares or preference stocks to the public. It appears as the owner’s or shareholders’ equity on the corporate balance sheet’s liability danangchothue.com more (both equity and preference capital), additional paid-in capitalAdditional Paid-in CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO. It is the profit a company gets when it issues the stock for the first time in the open danangchothue.com more, retained earnings as well as any equity reserve.

Formula

The formula for a capital account can easily be derived using the accounting equationAccounting EquationAccounting Equation is the primary accounting principle stating that a business’s total assets are equivalent to the sum of its liabilities & owner’s capital. This is also known as the Balance Sheet Equation & it forms the basis of the double-entry accounting system. read more. Let us first have a look at the accounting equation.

Bạn đang xem: tài khoản tài chính là gì

Assets = Liabilities + Capital

Đề xuất riêng cho bạn: Thuyết minh báo cáo tài chính – khái niệm và cách lập

As we can see, the amount of assets in any business at any point in time is the sum of its liabilities and capital. Thus, if we want to calculate the amount in the capital account, we need to use the below formula:

Capital = Assets – Liabilities

We can derive the amount of capital by reducing the number of liabilities from the number of assets reflecting on the balance sheetBalance SheetA balance sheet is one of the financial statements of a company that presents the shareholders’ equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the danangchothue.com more of any business.

Examples of Capital Account

Đáng xem: Share cho bạn 8 Chiến lược Khen thưởng Nhân viên Tối ưu

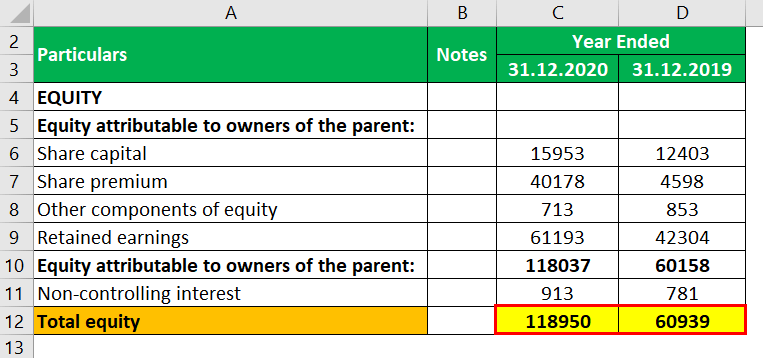

Let us have a look at the extracts of the balance sheet of a company, ABC Ltd. We will try to understand how the capital account of a company looks like:

As seen in the above balance sheet extracts, this account of a company is reflected as “Equity” in the balance sheet. The total equity includes different components of equity, such as share capital, share premium, retained earningsRetained EarningsRetained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner’s equity in the liability side of the balance sheet of the danangchothue.com more, and so on.

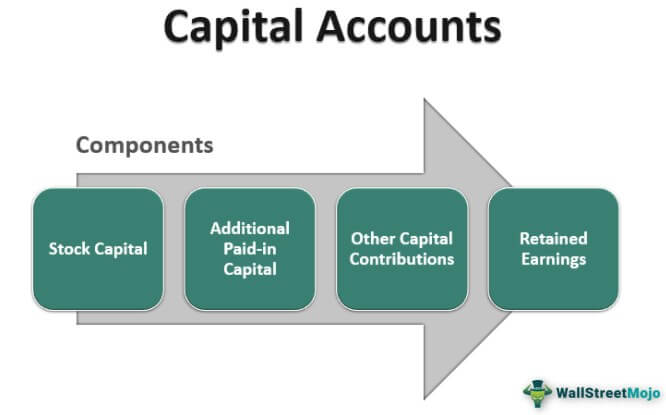

Components of Capital Accounts

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Capital Account (wallstreetmojo.com)

- Stock Capital: This includes the amount of equity and preference stock. It represents the amount invested by the stockholders against which they have been issued units of stocks.

- Additional Paid-in Capital: It represents the amount received from the stockholders in excess of face value. It is also known as “stock premium”.

- Other Capital Contributions: For sole proprietors and partnership firms, they would include the owners’ capital account, i.e. the capital balance of the sole proprietor and the partners, respectively.

- Retained Earnings: This represents the accumulated profits of a business on a particular date. Also, any reserves created out of such accumulated profits shall also be taken into account.

Importance

- The capital account becomes an essential part of the financial statementsFinancial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all danangchothue.com more of any business because it represents the amount that remains invested in the business by the owners on a particular day.

- We can use this amount to identify how much of assets have been financed with capital, i.e. owners and how much portion is debt-financed.

- This account can be used to calculate different financial ratiosFinancial RatiosFinancial ratios are indications of a company’s financial performance. There are several forms of financial ratios that indicate the company’s results, financial risks, and operational efficiency, such as the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratio, stability ratios, and so on.read more such as debt-equity ratioDebt-equity RatioThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity. It helps the investors determine the organization’s leverage position and risk level. read more, and so on.

- It helps the banks and other financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more to decide whether to grant further loans to such a business or not.

Limitations

- This account alone is not decisive for reaching any conclusion; if investors want to analyse the financial position of a business, they need to look at the entire balance sheet.

- The calculation can vary slightly from one business form to another.

Recommended Articles

This article has been a guide to what is a Capital Account in accounting and its definition. Here we discuss its examples, components, and importance. You may learn more about accounting from the following articles –

- Partnership Capital Account

- Current Account vs Capital Account

- Is Retained Earning an Asset?

- Appropriated Retained Earnings